In modern company catering, efficient and user-friendly payment options are an absolute must. Guests want to pay quickly and easily - after all, break time is valuable!

Companies need to act now and implement modern systems. In many restaurants, cash and refills are ubiquitous, even though they are no longer up to date. There are now a wide variety of payment methods in the mass catering sector.

Open-loop vs. closed-loop systems

The distinction between open-loop and closed-loop systems is a special feature of communal catering. Open-loop systems are payment methods that function in an open network and can be used by various acceptance points. In addition to cash, these include traditional credit and debit cards. Closed-loop systems, on the other hand, are limited to certain points of acceptance - a typical example is employee ID cards used to pay in the company restaurant. The decisive advantage over open-loop systems is the significantly higher level of control. In addition, there are usually lower transaction fees. And since use is limited to the company context, the system is also easier to manage.

Paying at the checkout

In many company restaurants, payment is still traditionally made in cash, by EC card or employee ID card at the till. The checkout stations are located either directly at the counter or separately in the restaurant. This method is widespread and enables direct human contact. However, there can be long queues, especially at peak times. In addition, the personnel costs are higher compared to self-checkouts.

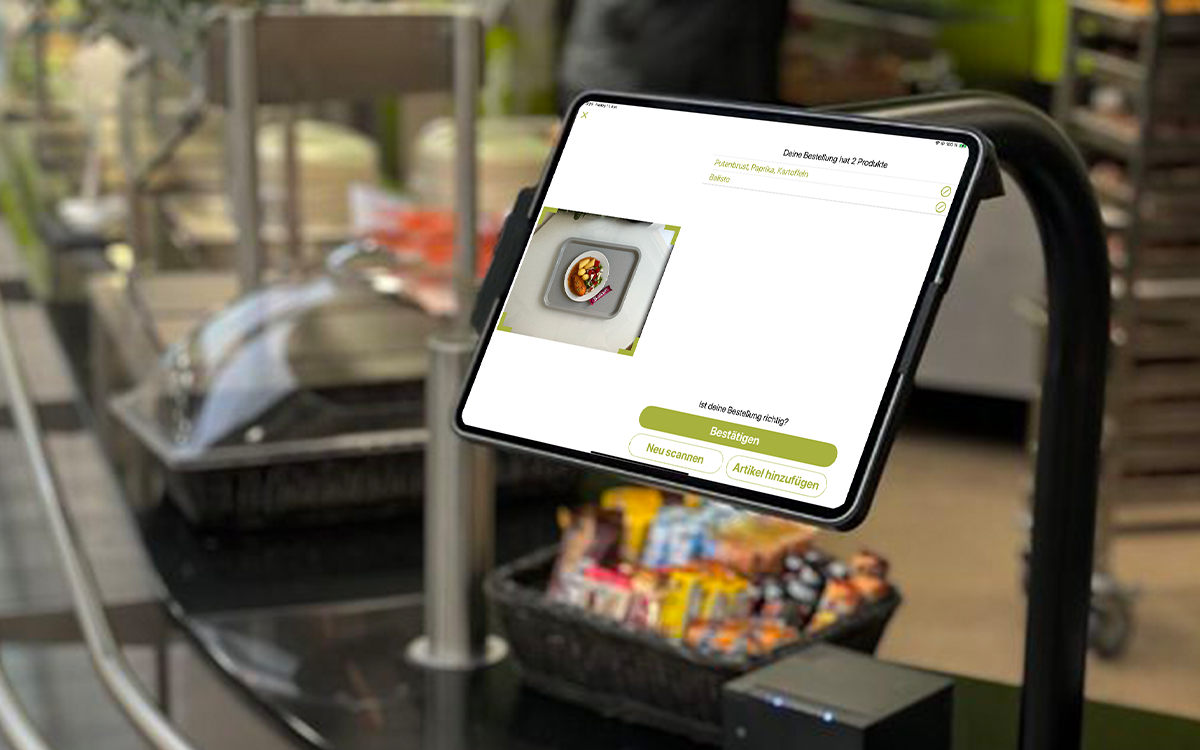

Self checkouts

Immer häufiger kommen Selfcheckouts zum Einsatz. Die Kassenarten reichen von kameragestützten Systemen über vordefinierte Mini-Kassen bis zu Smartphone-basierten Scan-Systemen. Gäste können ihre Bestellung eigenständig aufgeben und bargeldlos bezahlen. Der große Vorteil von SB-Kassen ist die deutlich reduzierte Wartezeit.

Payment portals

Payment portals are digital wallets that are topped up in advance (PrePay) or where guests are granted a credit line (PostPay). The credit is topped up and repaid via SEPA or credit card. The decisive advantage is that, on average, a transaction is only made once or twice a month. This drastically reduces transaction costs. The payment portal can also be used in a variety of ways in communal catering: for in-app payments, QR payments at the POS or via Bluetooth at vending machines.

Payment portals can be web-based or available as an app and offer a high degree of flexibility.

In-app payment

Die Mittagstisch-App ist die Grundlage für das In-App Payment. Damit können Gäste Bestellungen orts- und zeitunabhängig tätigen und über die hinterlegten Zahlarten bezahlen. Die Buchung erfolgt über SEPA-Lastschrift, PayPal, Kreditkarte, digitales Guthaben, Kostenstelle oder direkte Abrechnung über Lohn & Gehalt. Die Zahlart bietet mehr Komfort und Zeitersparnis für Gäste und eine einfache Nachverfolgung der Bestellhistorie.

QR Payment

For this payment method, the payment portal is linked to the smartphone: A separate QR code is generated for payment. This is scanned at the checkout or vending machine and deducts the amount from the payment portal balance. QR payment offers fast and contactless payment and replaces physical employee ID cards and revalue machines. However, a smartphone is required.

Conclusion: Modern payment options increase efficiency and user-friendliness

The choice of the right payment method for company catering depends on various factors, including the size of the company, the available budget and the technical requirements of the employees. Closed-loop systems offer more control and lower costs, while open-loop systems offer flexibility and broad acceptance. It is therefore essential to precisely analyze the specific needs of the company and its employees in order to implement the optimal payment methods. Modern payment options such as self-service terminals, in-app payments and QR payments offer numerous advantages that can make company catering more efficient and user-friendly.